unemployment tax refund calculator

Tax credits directly reduce the amount of tax you owe dollar for dollar. Have Social Security Income.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

If you used e-Collect and once the IRS and State agency have released your Refund money check the e-Collect Refund Status.

. Most federal tax refunds are issued within 21 days but some take longer. Estimate your tax refund and where you stand Get started. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

The American Rescue Plan Act of 2021 has provided a Relief to the Unemployed Taxpayers of the Society. For folks still waiting on the Internal Revenue Service. The Federal Internal Revenue Service Unemployment Tax Refund or Compensation Exclusion has been changed.

In addition any state tax refund you may be due will be applied to the overpayment in each year an overpayment. How to Request Direct Deposit. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount.

RequestView Status of Refund. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year. The fastest way to get your refund is to e-File your return and use direct deposit.

The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. Tax Refund Estimator For 2021 Taxes in 2022. Both reduce your tax bill but in different ways.

You can request a direct deposit right on your 1040 tax return if you want the money sent to just one account. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144 billion for tax year 2020. 2021 Tax Calculator to Estimate Your 2022 Tax Refund.

UCMS also offers TPAs the opportunity to manage UC Tax and account information online on behalf of their clients. Yes No Social Security Form SSA or Form 1042S. And is based on the tax brackets of 2021 and 2022.

The IRS Tax Refund 10200 and 150000 for Unemployment Tax Break Refund Calculator. The Self-Services that are available will vary depending on the TPAEmployer. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate.

It is mainly intended for residents of the US. If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment you dont need to file an amended return or take any other. ViewMake Online Solvency Fee Payment.

You did not get the unemployment exclusion on the 2020 tax return that you filed. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. IRS Unemployment Tax Refund.

Obtain Certifications and Clearances. If you are still claiming benefits your overpayment will be deducted from your weekly unemployment payments until the overpayment is repaid. Hi IKRAM 1998 The American Rescue Plan Act of 2021 enacted on March 11 2021 suspended the requirement to repay excess advance payments of the premium tax credit excess APTC for tax year 2020.

Indicate your banks routing transit number your bank account number and the type of accountchecking or savingson lines 35b 35c and 35d of your Form 1040 for tax return. This means you will be without unemployment benefits until the overpayment is paid back. Check the State Tax Return status of your 2021 State Returns.

2021 Tax Refund Status In 2022. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Real Estate Tax.

Yes No Self-Employment Form 1099-NEC or 1099-MISC.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

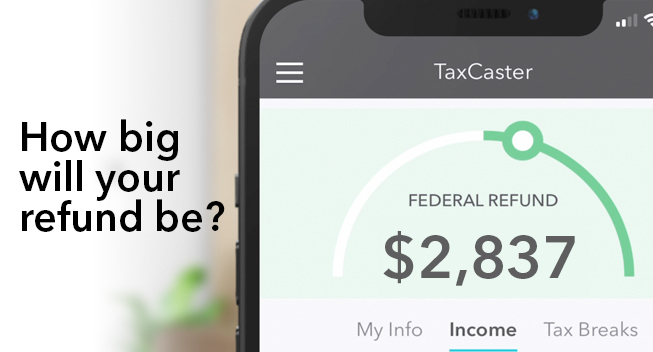

Estimate Your Tax Refund With The Turbotax Taxcaster The Turbotax Blog

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

If I Paid Taxes On Unemployment Will I Get A Refund

Irs Use These Calculators To Estimate Your Tax Refund Fingerlakes1 Com

Illinois Dept Of Revenue To Begin Issuing Tax Refunds For Eligible Residents Who Received Unemployment Benefits News Wsiltv Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Calculate Your Exact Refund From The 10 200 Unemployment Tax Break How Much Will You Get Back Youtube

Tax Calculator Estimate Your Taxes And Refund For Free

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Estimate Your Tax Refund Lovetoknow

Irs Tax Refund Schedule 2022 Irs Gov Tax Refund Dates 2022 Calculator Calendar

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

How To Get A Refund For Taxes On Unemployment Benefits Solid State

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-18-2022/t_13622eb93921470d9be3838b9df59189_name_IRS_will_begin_accepting_2021_tax_returns_on_Jan__24_Poster.jpg)

If State Determines It Overpaid Unemployment Benefits It Can Garnish Your Tax Refund Wsoc Tv